Resources

Federal Reserve Expands Scope and Eligibility of Main Street Lending Program

On April 30, 2020, the Federal Reserve announced changes to its Main Street Lending Program that will expand the loan options available to businesses and increase the maximum size of the companies that are eligible for support under the Program.

Key Changes to Original Terms of the Program

- The Federal Reserve has created a third loan option, called the Main Street Priority Loan facility, with increased risk sharing by lenders for borrowers with greater leverage.

- Businesses with up to 15,000 employees or up to $5 billion in annual revenue are now eligible for loans, compared to the initial Program terms, which were for companies with up to 10,000 employees and $2.5 billion in revenue.

- The minimum loan size for two of the facilities was also lowered to $500,000 from $1 million.

- The Federal Reserve initially required banks to price the loans using the Secured Overnight Financing Rate (SOFR), a newer benchmark that is due to replace the London Inter-Bank Offered Rate (LIBOR) next year; however, in response to industry feedback during the comment period, the loans will now be priced using the LIBOR benchmark.

- In addition, the definition of eligible lender has been expanded to include U.S. branches or agencies of a foreign bank, U.S. intermediate holding companies of a foreign banking organization, or U.S. subsidiaries of any of the foregoing. At this time, nonbank financial institutions are not considered eligible lenders for purposes of the Program.

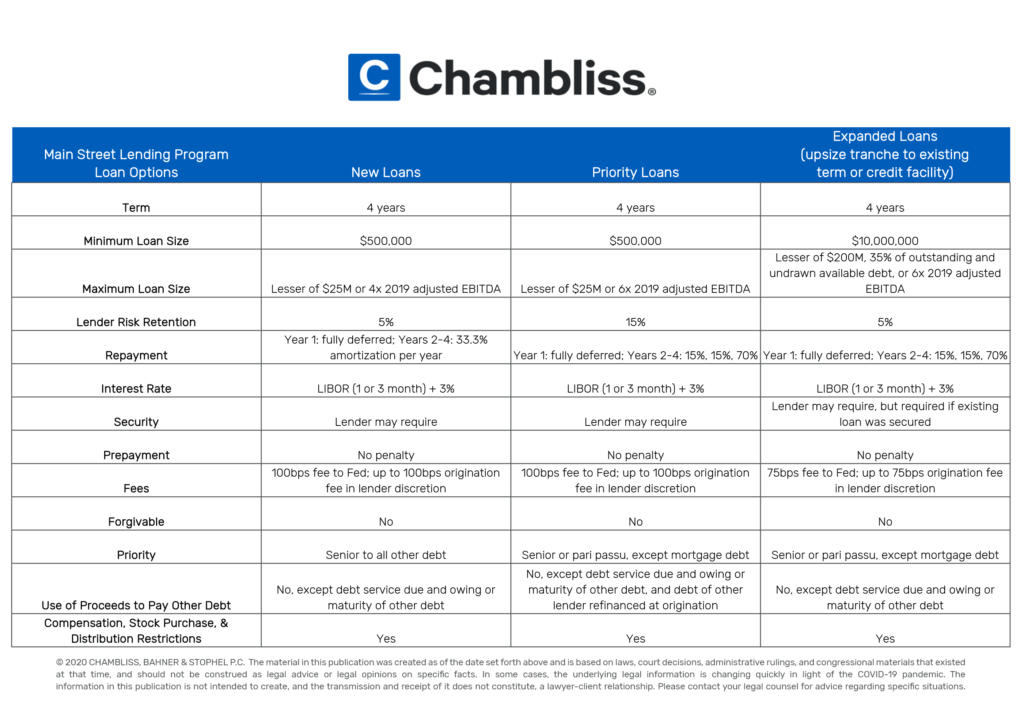

Main Street Lending Program Loan Options

The Main Street Lending Program now includes three facilities, all of which use the same eligible lender and eligible borrower criteria and have many of the same features, including the same maturity, interest rate, deferral of principal and interest for one year, and ability of the borrower to prepay without penalty. Other features of the loans extended in connection with each facility differ, including how they interact with the eligible borrower’s existing outstanding debt. Key characteristics of each facility are set forth below:

Important Considerations

Businesses that have received Paycheck Protection Program (PPP) loans are permitted to borrow under the Main Street Lending Program, provided that they are eligible borrowers. In contrast to loans under the PPP, Main Street loans are full-recourse loans and are not forgivable. If you have questions, please contact Andy Leffler, Laura McKinney, or your relationship attorney.

Visit our COVID-19 Insight Center for our latest legislative and legal updates, articles, and resources.

The material in this publication was created as of the date set forth above and is based on laws, court decisions, administrative rulings, and congressional materials that existed at that time, and should not be construed as legal advice or legal opinions on specific facts. In some cases, the underlying legal information is changing quickly in light of the COVID-19 pandemic. The information in this publication is not intended to create, and the transmission and receipt of it does not constitute, a lawyer-client relationship. Please contact your legal counsel for advice regarding specific situations.